Checking eligibility will not impact credit. If you decide to pay with installments through Affirm, your payment plan and repayment activity may be reported to credit bureaus. You can find more information on Affirm's Help Center.

Buy now, pay later without the fees

Affirm is a smarter way to pay over time. Shop and pay at your own pace without any fees, so you can get the things you love without breaking your budget.

The choice is yours

Affirm Pay in 4

Make 4 interest-free payments every 2 weeks. Great for everyday purchases.

No interest or fees

No impact on your credit score

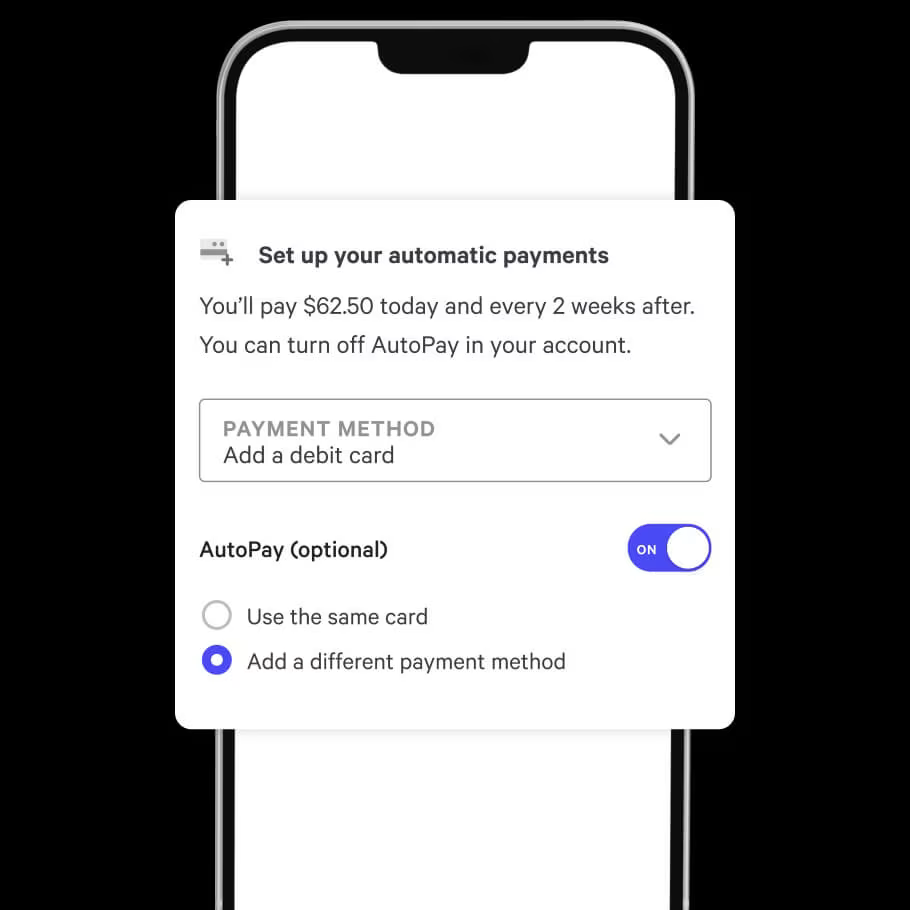

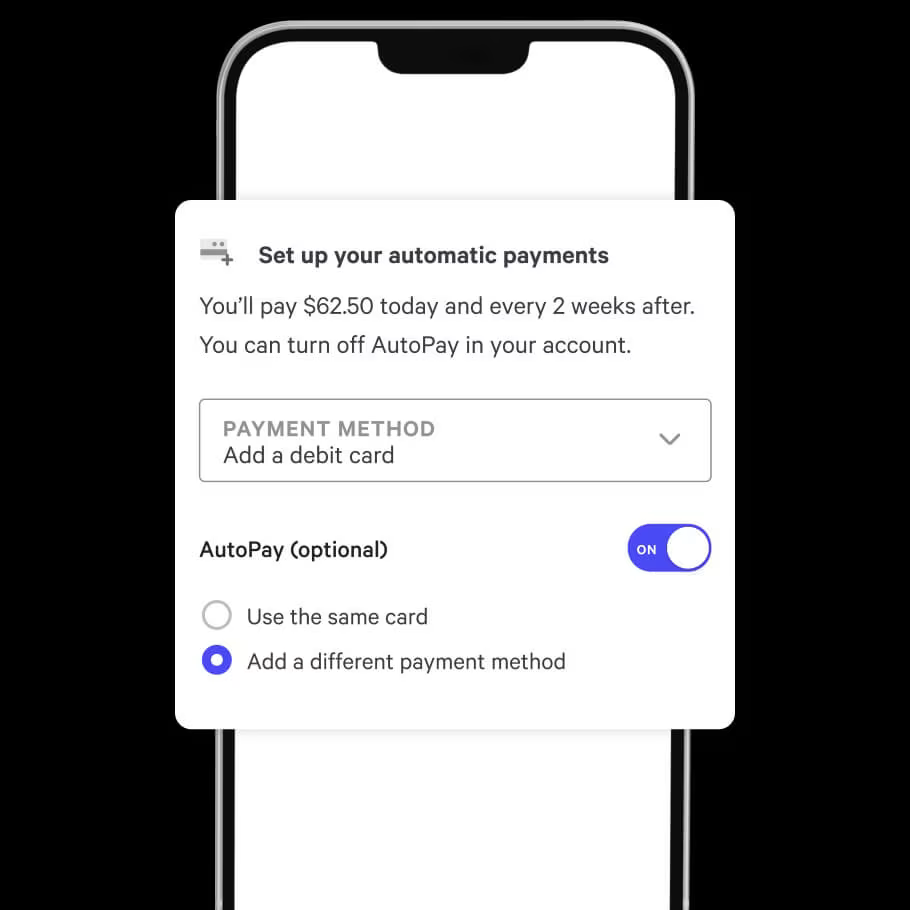

Set up easy, automatic payments

Monthly payments

Choose monthly installments. Perfect for big-ticket items.

No hidden fees—ever

What you see is what you pay

Set up easy, automatic payments

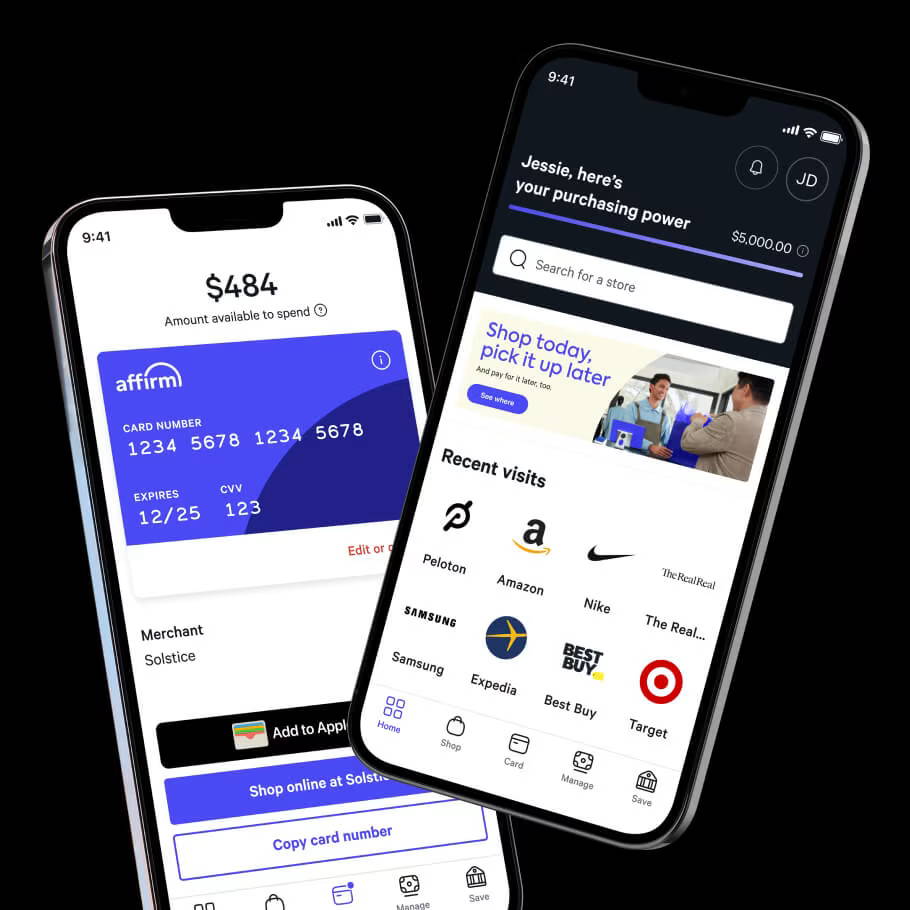

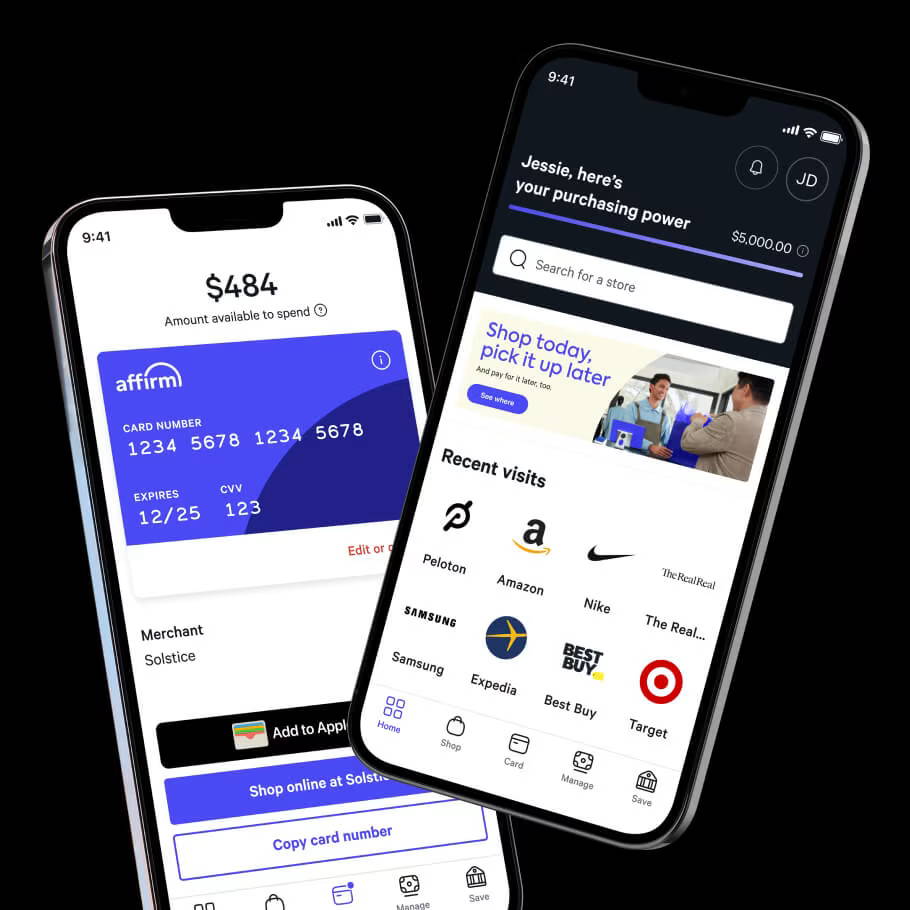

How to buy with Affirm

STEP 1

Go shopping

Shop for your perfect PC and pay later with Affirm. Just select Affirm at checkout when shopping to see your payment options.

This eligibility check won't affect your credit score. See footer for details.

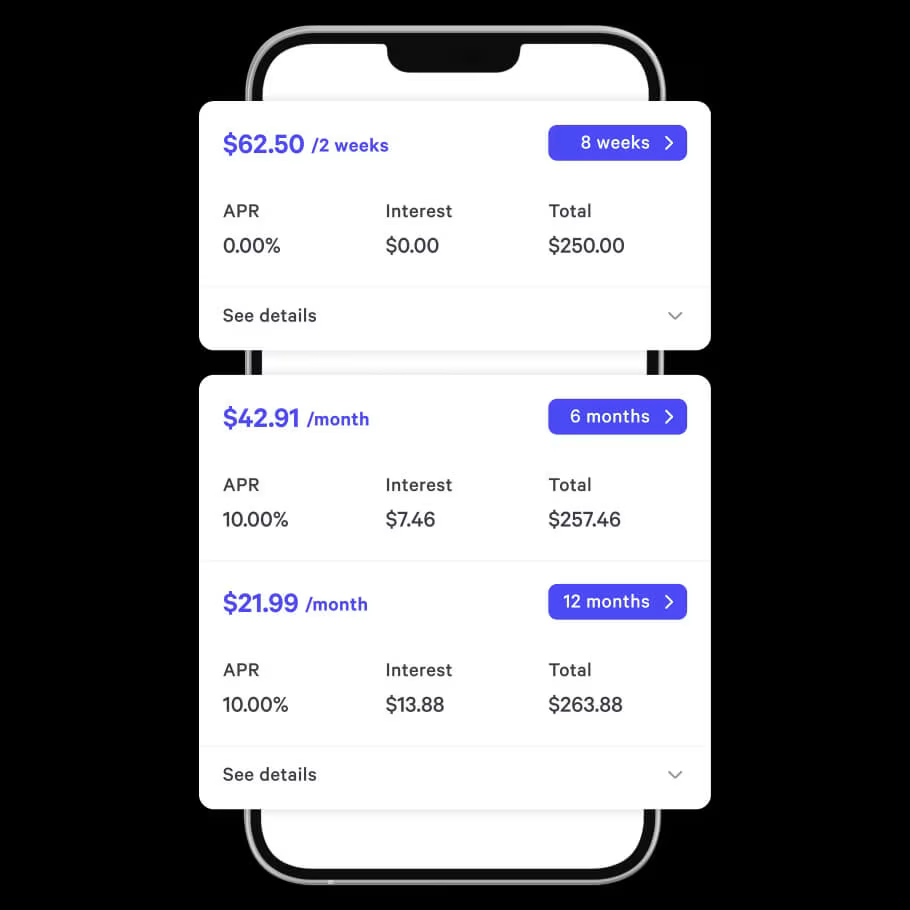

STEP 2

Choose your payment terms

You’re in control. Pick the payment option that works for you and your budget—from 4 interest-free payments every 2 weeks to monthly installments.

STEP 3

Make your payments

Manage your payments in the Affirm app or online, and set up AutoPay so you don’t miss a payment. But if you do, you’ll never pay any fees.

Why Affirm?

With Affirm, you’ll never owe more than you agree to up front. Instead, you’ll always get a flexible, transparent, and convenient way to pay over time.

We keep it simple

When you can choose a payment option that suits your budget, it’s easy to get that interview outfit or go on your dream vacation.

We never charge fees

You'll never pay late fees. Or annual fees. Or hey-it's-a-random-day-in-April fees.

We tell it like it is

With credit cards, the longer you take to pay off your balance, the more expensive your purchase becomes. With Affirm, you always know exactly what you'll owe and when you'll be done paying off your purchase.

It’s all about you

Transparent

We tell you up front the total amount you’ll pay. That number will never go up.

Flexible

You choose the payment schedule that works for you.

Fair

You’ll never pay late fees, penalties, or hidden interest, ever.

Questions? We’re here to help

Will Affirm affect my credit score?

Does Affirm charge interest and fees?

Fees - We don’t charge any fees. That means no late fees, no prepayment fees, no annual fees, and no fees to open or close your account.

Interest - Depending on the size of your purchase and where you’re shopping, your payment plan may include interest. You’ll never owe more interest than you agree to on day one—so you always know exactly what you’re getting into.

What does purchasing power mean?

Your purchasing power is an estimate of how much you are prequalified to spend with Affirm. You don't have to use the full amount, and you're not on the hook to pay anything back until you actually make a purchase.

Can I return an item I bought with Affirm?

Yes—you can return an item you bought with Affirm by initiating the return process with the store.

Need more info?

We’ve got you.

Payment options through Affirm are provided by these lending partners: affirm.com/lenders. Your rate will be 0–36% APR based on credit, and is subject to an eligibility check. Affirm Pay in 4 payment option is 0% APR. Options depend on your purchase amount, may vary by merchant, and may not be available in all states. A down payment may be required. For example, a $800 purchase could be split into 12 monthly payments of $72.21 at 15% APR, or 4 interest-free payments of $200 every 2 weeks. Affirm savings accounts are held with Cross River Bank, Member FDIC. California residents: Affirm Loan Services, LLC is licensed by the Department of Financial Protection and Innovation. Loans are made or arranged pursuant to California Financing Law license 60DBO-111681. The Affirm Card is a Visa® debit card issued by Evolve Bank & Trust, Member FDIC, pursuant to a license from Visa U.S.A. Inc. The Affirm Card is not available to residents of U.S. territories. Affirm, Inc., NMLS ID 1883087. Affirm Loan Services, LLC, NMLS ID 1479506. For licenses and disclosures, see affirm.com/licenses.